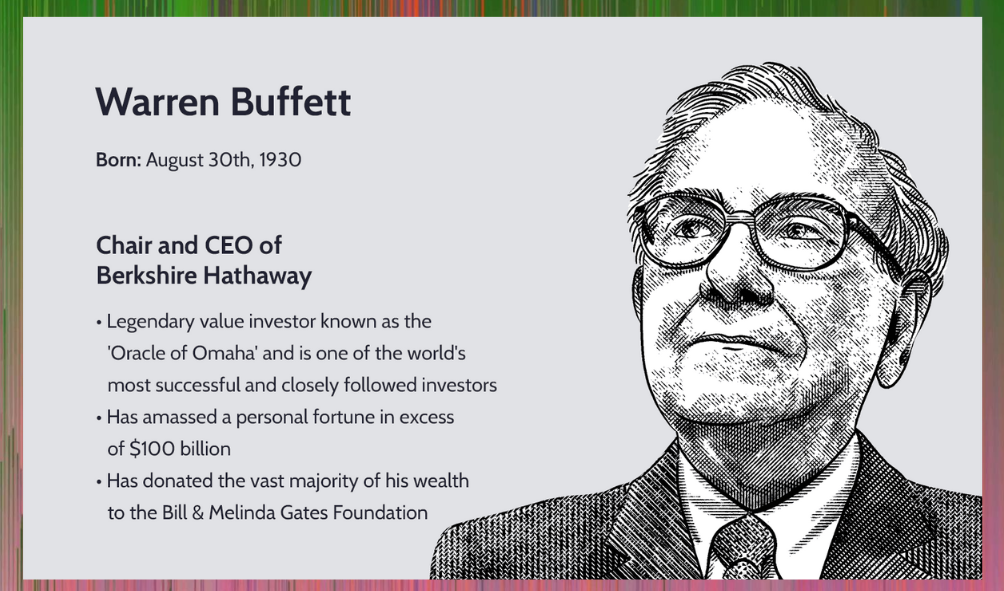

These 10 Ways To Invest Using Warren Buffett Investment Strategy, Imagine building a financial fortress, brick by brick, that steadily grows in value over decades. This is the essence of Warren Buffett’s investing philosophy. Often dubbed the “Oracle of Omaha,” Buffett has garnered a cult-like following for his remarkable track record. His conglomerate, Berkshire Hathaway (BRK.A), has delivered a staggering average annual return of 20% since 1965, far exceeding the S&P 500’s average of roughly 10%. [1]

But what exactly makes Buffett’s approach so successful? And more importantly, how can you, as an investor, incorporate his wisdom into your own strategy? In this article, we’ll delve into the core principles of Buffett’s value investing strategy, translating them into 10 actionable takeaways that can empower you to achieve long-term financial success.

#1. Value Investor: Focus on Intrinsic Worth

Buffett’s philosophy hinges on the concept of intrinsic value. This refers to the true, underlying worth of a business, independent of its current stock price. Just like a house can be overpriced or underpriced in the real estate market, stock prices can fluctuate wildly due to market sentiment. The goal of a value investor is to identify companies whose intrinsic value is significantly higher than their current market price. By buying such stocks, you’re essentially acquiring a valuable asset at a discount, positioning yourself for significant gains as the market catches up to the company’s true worth.

A 2023 study found that value investing strategies outperformed growth strategies by a reasonable figure over a period of years [2]. This compelling evidence underscores the effectiveness of Buffett’s core principle. Don’t get swept away by the market’s short-term gyrations. Instead, focus on identifying companies with strong fundamentals and a bright future, and wait patiently for the market to recognize their true value.

#2. Beyond the Ticker Symbol: Understanding the Business

Imagine blindly throwing darts at a stock chart. That’s not investing; it’s gambling. Buffett emphasizes the importance of thorough company research. Before you even consider adding a stock to your portfolio, you should have a deep understanding of the underlying business. This involves analyzing financial statements, competitive landscapes, management teams, and long-term growth prospects.

Think of yourself as a detective, piecing together the puzzle of a company’s true potential. Is the business operating in a growing industry with sustainable competitive advantages? Does the company have a strong track record of profitability and a clear path for future earnings growth? Is the management team competent, ethical, and shareholder-focused? By asking these critical questions, you’ll be well-equipped to separate the diamonds from the rough in the stock market.

#3. Building Moats: The Power of Competitive Advantages

In the world of investing, a strong company is like a well-fortified castle. The key to its success lies in its economic moat. This refers to a sustainable competitive advantage that protects a company from new entrants and existing rivals. Think of brands like Coca-Cola (KO) or Apple (AAPL) with their devoted customer bases and powerful brand loyalty. These are classic examples of companies with wide economic moats.

The presence of an economic moat is crucial because it allows a company to generate consistent profits over time. Look for companies with strong intellectual property, unique technological advantages, or dominant market share. These characteristics act as powerful barriers to entry, making it difficult for competitors to steal market share and erode the company’s profitability.

#4. Patience is Your Ally: Investing for the Long Haul

Buffett famously advocates for a buy-and-hold philosophy. He emphasizes the importance of investing with a long-term perspective, typically measured in decades, not days or weeks. The short-term gyrations of the market shouldn’t dictate your investment decisions. Instead, focus on companies with strong fundamentals and the potential for sustained growth over the long term.

Think of yourself as planting a seed. Just like an oak tree takes years to mature, it takes time for a company’s true value to be fully reflected in its stock price. Resist the urge to panic sell at the first sign of market volatility. By adopting a long-term mindset, you’ll be well-positioned to weather market storms and reap the rewards of compound interest over time.

#5. Taming the Inner Trader: The Virtue of Patience

Let’s face it, the urge to constantly tinker with your portfolio can be strong. However, Buffett reminds us of the importance of patience especially for new investors, the temptation to chase hot stocks or react impulsively to market fluctuations can be overwhelming. However, Buffett emphasizes the importance of resisting these urges. Frequent trading not only racks up transaction fees but also increases your chances of making emotional decisions that could hurt your long-term returns.

Here’s an analogy to consider: Imagine yourself buying a basket of delicious, ripe fruit. You wouldn’t throw the entire basket away just because one or two apples started to bruise, would you? The same principle applies to your stock portfolio. Focus on the long-term health and growth potential of your investments, and avoid making rash decisions based on short-term market noise.

#6. Think Like an Owner: Aligning Your Interests with the Company’s

When you invest in a company, you’re not just buying a stock; you’re essentially becoming a part-owner of that business. Buffett encourages investors to adopt an ownership mentality. This means viewing your stock holdings as long-term investments in companies you believe in, rather than just pieces of paper to be traded for a quick profit.

By thinking like an owner, you’ll be more likely to make decisions that align with the company’s long-term success. This means prioritizing companies with strong management teams, ethical business practices, and a clear vision for the future. After all, the success of your investments is ultimately tied to the success of the underlying businesses you own.

#7. Mr. Market: Capitalizing on Market Volatility

Buffett famously uses the metaphor of “Mr. Market” to describe the stock market. Imagine Mr. Market as a somewhat erratic business partner who shows up at your door every day offering to buy or sell your shares of a company you co-own. Sometimes, Mr. Market might be feeling overly optimistic and offer you an inflated price for your shares. Other times, he might be feeling pessimistic and practically give them away.

The key to profiting from Mr. Market’s mood swings is to be a disciplined investor. When Mr. Market is euphoric and overvaluing quality businesses, resist the urge to sell. Instead, view it as an opportunity to buy more shares at a discount. Conversely, when Mr. Market is feeling down and undervaluing good companies, be ready to pounce and add these valuable assets to your portfolio.

#8. The Power of Compounding: Time is Your Friend

Albert Einstein famously called compound interest the “eighth wonder of the world.” Buffett wholeheartedly agrees. Compound interest allows your money to grow exponentially over time. The earlier you start investing and the longer you hold your investments, the more the power of compounding can work its magic on your portfolio.

Let’s illustrate this with an example. Imagine you invest $1,000 at a young age and achieve an average annual return of 10%. Over 40 years, thanks to compounding, that initial investment could grow to over $140,000! The key takeaway? Start investing early, even with small amounts, and let time and compound interest work their magic on your nest egg.

#9. The 90/10 Rule: Diversification for Peace of Mind

While Buffett is a celebrated stock picker, he also recognizes the importance of diversification. His famous 90/10 rule suggests allocating 90% of your portfolio to low-cost index funds and 10% to individual stock picks. Index funds passively track a specific market index, such as the S&P 500, offering broad diversification and historically consistent returns.

This approach is particularly suitable for investors who lack the time or expertise for in-depth company research. By allocating the majority of your portfolio to index funds, you gain exposure to a basket of companies, mitigating the risk of any single company underperforming. The remaining 10% allows you to explore individual stock-picking opportunities if you have the interest and skills.

#10. Keeping Costs Low: Every Penny Counts

Transaction fees, expense ratios, and other investment costs can eat significantly into your returns over time. Buffett is a staunch advocate for keeping your investment costs low. This means favoring low-cost index funds with minimal expense ratios and avoiding unnecessary trading activity.

Think of investment fees as a leak in your investment bucket. The more leaks you have, the less money remains to grow and compound over time. By keeping your costs low, you maximize the potential returns on your investments.

Conclusion: Building Your Investment Fortress

Warren Buffett’s investment philosophy offers a powerful roadmap for long-term financial success. By adopting the core principles outlined above, you can transform yourself from a passive market participant into an active investor, capable of making informed decisions and building a resilient portfolio. Remember, investing is a marathon, not a sprint. Discipline, patience, and a long-term perspective are your most valuable assets.

Here are some key takeaways to remember:

- Focus on Value: Seek out companies trading below their intrinsic value.

- Understand the Business: Conduct thorough research before investing.

- Seek Competitive Advantages: Look for companies with strong economic moats.

- Invest for the Long Term: Adopt a buy-and-hold mentality.

- Be Patient: Resist the urge for emotional and impulsive trading.

- Think Like an Owner: Align your interests with those of the company.

- Capitalize on Volatility: Be a disciplined investor who takes advantage of Mr. Market’s mood swings.

- Harness the Power of Compounding: Start investing early and let time work its magic.

- Diversify for Peace of Mind: Consider the 90/10 rule for a balanced approach.

- Keep Costs Low: Every penny counts in the long run.

By incorporating these principles into your investment strategy, you’ll be well on your way to building your own financial fortress, brick by brick. Remember, the stock market may fluctuate, but by focusing on the fundamentals and taking a long-term perspective, you can position yourself to achieve your financial goals.

Disclaimer: Past performance does not guarantee future results. This article is for informational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Further Reading:

- “The Intelligent Investor” by Benjamin Graham (Buffett’s mentor)

- “The Essays of Warren Buffett” by Lawrence A. Cunningham

- “Buffett: The Making of an American Capitalist” by Roger Lowenstein

Read Also | Warren Buffett’s Wealth Journey: The Stuff That Billionaires Come From