Have you ever wondered how someone accumulates a fortune as vast as Warren Buffett’s? The “Oracle of Omaha” boasts a net worth exceeding $100 billion, a staggering figure that inspires awe and curiosity in equal measure. As an investment researcher, I’ve spent years dissecting Buffett’s strategies, and today, I’m here to share the key ingredients in his wealth recipe. It’s a story that goes beyond simply picking winning stocks – it’s a testament to the power of time, calculated decisions, and a sprinkle of genius.

Warren Buffett’s Wealth Journey: Early Habits That Laid the Foundation

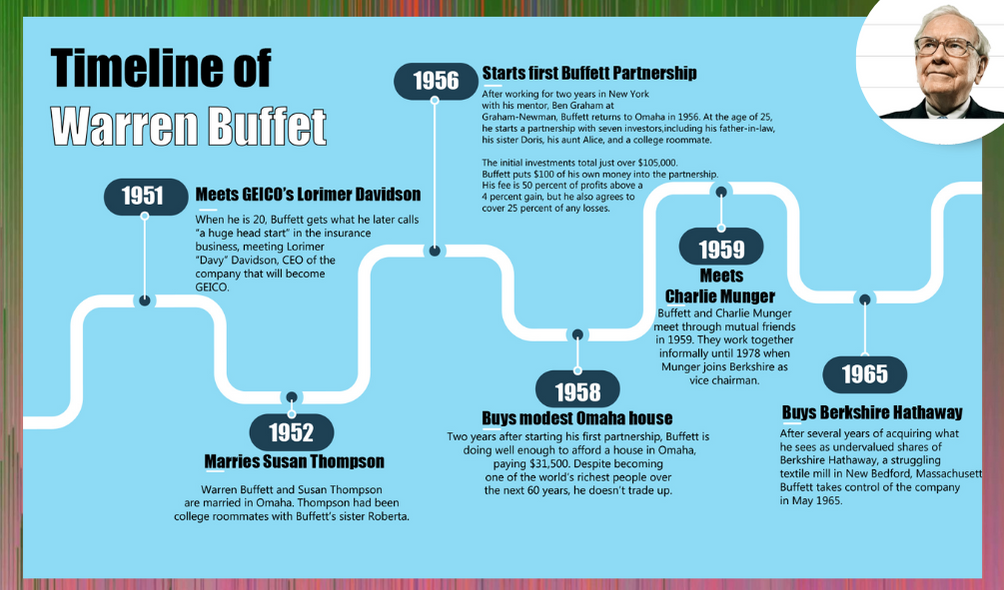

It is in his disciplined manner of investing and adherence to the principles of value investing that one sees the wealth journey of Warren Buffett. Buffett started investing early in his life. He bought his first stock when he was 11, and at 14, he made his first real estate investment. His fortune was built with highly researched and timely purchases of undervalued stocks and companies, which he retained over a long period. The success of Buffett lies in finding high-quality companies trading at fair market values and holding on to them over an extended period of time, thereby allowing the magic of compounding to take over.

Over the years, Buffett has strategically invested in companies like Coca-Cola, American Express, and Bank of America, among many others, which were the major contributors to his wealth accumulation. His net worth has gone north in a big way, crossing $100 billion, one of the most affluent individuals in the world. Still, Buffett does not indulge in personal spending extravagantly and believes in giving back much of the money made to society through philanthropy.

Key factors in this investment journey of his have been his early exposure to finance, his study under one of the pioneers of value investing, Benjamin Graham, and his contrarian approach toward investing. Another important factor that must be looked into is the partnership between Buffett and Charlie Munger and the commitment to long-term value creation. Value investing, continuous learning, and prudence in his investment decisions have been the major pillars behind Buffett’s incredible wealth journey.

The Magic of Compound Interest: Your Money Working for You

Imagine this: you invest $1,000 at an annual interest rate of 7%. In one year, you’ll earn $70 in interest. But here’s the beauty of compound interest – in year two, you not only earn interest on the initial $1,000, but also on the $70 you earned in year one. This snowball effect can lead to exponential growth over time. A recent study by Fidelity Investments, 2023 found that a lump sum investment of $10,000, grown at a hypothetical 7% annual return for 30 years, could balloon to over $160,000. Now imagine starting young and letting compound interest work its magic for decades – that’s the magic Buffett harnessed throughout his career.

The Power of Partnerships: When One Plus One Equals Billions

While Buffett’s early forays were impressive, his wealth truly skyrocketed when he started forming investment partnerships. Partnering with others allowed him to pool capital, diversify holdings, and benefit from shared knowledge and expertise. One particularly influential collaboration was with Benjamin Graham, a renowned value investor who mentored Buffett at Columbia Business School. Graham’s teachings on value investing – focusing on companies with strong fundamentals trading below their intrinsic value – became the cornerstone of Buffett’s investment philosophy.

Berkshire Hathaway: The Platform for Long-Term Growth

In 1965, Buffett acquired a struggling textile company called Berkshire Hathaway. Instead of reviving the textile business, he used it as a shell to acquire controlling interests in other undervalued companies. This transformed Berkshire Hathaway into a holding company, a financial powerhouse that continues to be the primary vehicle for Buffett’s investments. Berkshire Hathaway’s flexibility allows him to invest in a wide range of assets, from stocks and bonds to real estate and subsidiaries.

The Billion-Dollar Bet: Identifying Buffett’s Greatest Investment

Pinpointing a single investment as Buffett’s greatest is challenging. However, many experts argue that his long-term holding in Apple stands out. In 2016, Berkshire Hathaway began accumulating Apple stock, eventually becoming the company’s fifth-largest shareholder. As Apple’s stock price soared over the years, so did the value of Berkshire Hathaway’s stake. This single investment is estimated to have contributed tens of billions of dollars to Buffett’s net worth. It exemplifies his core principle of buying excellent companies for the long haul and letting their intrinsic value shine through.

Why Warren Buffett? Timeless Investment Principles We Can All Learn From

So, what exactly makes Buffett’s approach so successful? It boils down to a set of core investment principles that have stood the test of time. Here are a few key takeaways:

- Value Investing: Buffett prioritizes companies with strong financials, solid competitive advantages, and a track record of profitability, even if their stock prices seem temporarily undervalued.

- Long-Term Focus: He avoids short-term market fluctuations and instead focuses on companies with the potential for sustained growth over decades.

- Disciplined Risk Management: While he isn’t afraid of calculated risks, Buffett meticulously analyzes potential investments and avoids chasing fads or overpaying for assets.

Where is the Oracle Now?

Today, at 93 years old, Warren Buffett remains actively involved at Berkshire Hathaway, serving as Chairman and CEO. He continues to champion his value investing philosophy and is revered for his folksy wisdom and annual shareholder letters, which are dissected by investors worldwide. Beyond business, Buffett is a renowned philanthropist, having pledged to donate the vast majority of his fortune to charitable causes.

Becoming a Billionaire: A Timeline of Success

While an exact date is difficult to pinpoint, credible sources estimate that Warren Buffett crossed the billionaire threshold sometime in the late 1980s or early 1990s. This coincides with Berkshire Hathaway’s period of explosive growth, fueled by strategic investments and a booming stock market. It’s a testament to the power of his long-term investment approach.

From Paper Route to Millions: The Seeds of Success

While a billion seems like an unimaginable sum, Buffett’s journey to his first million serves as an inspiration. Historians estimate that he achieved millionaire status by his mid-twenties. This likely stemmed from a combination of factors: the profits from his early ventures like the paper route and real estate, the returns from his personal investment partnerships, and the snowball effect of compound interest working on his early investments.

Starting Small: How Much Did Buffett Invest Initially?

The exact amount of Buffett’s first investment is unknown, but it was likely a modest sum. Remember, he was just 11 years old when he purchased those three shares of Cities Service Preferred. What mattered more than the initial sum was the consistent effort he put into saving and investing throughout his youth. This early commitment laid the foundation for his future financial success.

By the Numbers: A Snapshot of Buffett’s Wealth

- Warren Buffett Net Worth: As of May 2024, Forbes estimates Warren Buffett’s net worth to be over $100 billion, solidifying his place as one of the wealthiest individuals in the world.

- Warren Buffett Age: As mentioned earlier, Buffett is currently 93 years old, proving that age is no barrier to continued success and financial growth.

Beyond the Numbers: What Buffett Invests In and How He Thinks

While specific companies come and go in Berkshire Hathaway’s portfolio, Buffett generally gravitates towards businesses in established industries with strong brands, consistent profitability, and limited competition. He often refers to these as “economic castles” – companies with sustainable moats protecting their market share.

Here are a few of his most famous investment quotes that encapsulate his philosophy:

- “Price is what you pay; value is what you get.” – This quote emphasizes the importance of focusing on a company’s intrinsic value rather than just its current stock price.

- “Be fearful when others are greedy, and greedy when others are fearful.” – This highlights the importance of contrarian investing, buying when the market is down and avoiding the herd mentality.

- “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” – This reiterates his focus on quality businesses over bargain-basement stocks.

Frequently Asked Questions: Unveiling the Man Behind the Billions

Q: What was Warren Buffett’s educational background?

A: Though rejected by Harvard, Buffett attended Columbia Business School where he studied under Benjamin Graham, the father of value investing.

Q: Did Warren Buffett ever make any investment mistakes?

A: As with any investor, Buffett has made some investments that haven’t panned out as expected. He himself acknowledges these mistakes and emphasizes the importance of learning from them.

Q: Can I replicate Warren Buffett’s success?

A: While replicating his exact wealth accumulation might be unrealistic, you can certainly adopt his core investment principles. Focus on value investing, prioritize long-term growth over short-term gains, and manage risk wisely. Remember, consistency and patience are key ingredients in building long-term wealth.

Conclusion: Lessons Learned from the Oracle of Omaha

Warren Buffett’s journey is a masterclass in calculated risk-taking, unwavering discipline, and the power of time. His story is a reminder that building wealth is a marathon, not a sprint. By adopting his core principles, focusing on the long term, and harnessing the magic of compound interest, you too can pave the way for a secure and prosperous financial future. Remember, the road to wealth starts with a single step, so why not take yours today?

Also Read | Bank Fraud Protection: TSB and Co-op Customers at Risk