The Federal Government of Nigeria has announced plans to reduce the country’s growing debt service burden by refinancing existing debts with cheaper alternatives, as part of ongoing efforts to stabilize the economy and ease fiscal pressures.

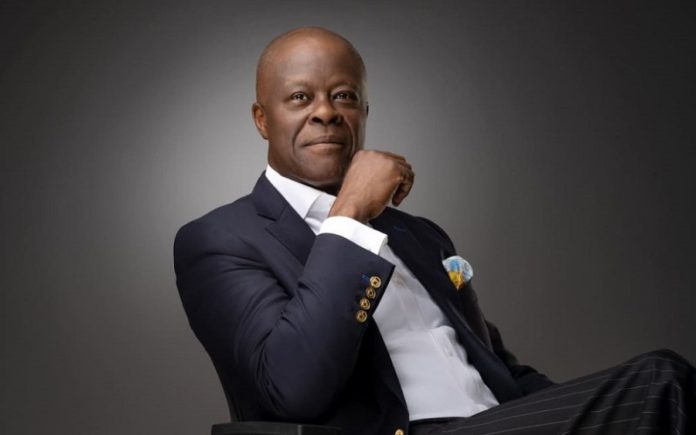

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, made this disclosure on Tuesday, October 7, at the opening session of the Annual Conference of the Institute of Chartered Accountants of Nigeria (ICAN) held in Abuja.

Edun said the administration is actively pursuing strategies to replace expensive debts with lower-interest financing options, thereby reducing both the cost of borrowing and debt servicing obligations.

“Efforts are underway to refinance expensive debt and thus reduce both the debt service cost and the cost of borrowing,” he stated. He explained that while recent Economy had significantly increased government revenue, the gains have been offset by a sharp rise in debt servicing costs.

“Our fiscal position has improved significantly. Revenue has grown by over 70 percent in nominal terms over the past two years, driven by the liberalisation of the foreign exchange and fuel markets, and automation-led revenue collection under the Renewed Hope Agenda,” Edun said.

However, he noted that expenditure pressures persistwhiteTreasury bill rates on8 percent in 2023 to nearly 24 percent, and external debt servicing alpine pasturetripling from a budgeted ₦2.7 Trillion in 2024.

Edun assured that the government remains focused on building a resilient and inclusive economyintransitioning toward diversification, competitiveness, and private-sector-led growth.

“Our strategic priorities include significant improvement in non-oil export growth, enhancing domestic productivity, and fostering inclusive prosperity by ensuring that vulnerable Nigerians are not left unprotected,” he said.

A f seeks to establish an open and efficient market system where the private sector drives growth while the government serves as an enabler and regulator.

“Our growth strategy is centred on productive capital formation through increased private investment. We are working to achieve output growth of 7.0 percent GDP by 2027/2028, thereby enabling the removal of millions of our citizens from poverty,” Edun added.

The finance minister reiterated that ongoing fiscal and structural reforms under the Renewed Hope Agenda are aimed at restoring macroeconomic stability, reducing public debt vulnerabilities, and creating a more sustainable growth trajectory for the Nigerian economy.