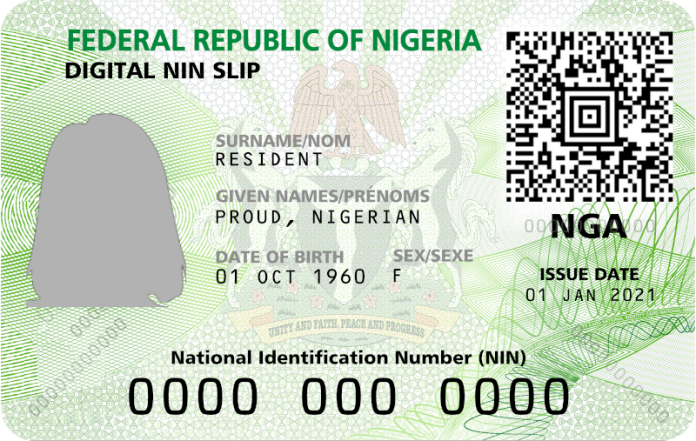

The Federal Government is set to roll out a reform linking Nigerians’ credit scores to their National Identification Numbers (NIN).

The move is designed to establish a unified and transparent credit system across the country.

Managing Director of the Nigerian Consumer Credit Corporation (CREDICORP), Uzoma Nwagba, announced the development at a State House media briefing in Abuja, Tuesday, June 17.

He said the initiative aims to consolidate credit data from all financial institutions, banks, fintechs, and microfinance providers into a central national credit bureau.

“This marks a fundamental shift in how credit works in Nigeria. Your NIN becomes your financial anchor. Whether you’ve borrowed from a bank, micro-lender, or fintech, your record will be tracked and will carry consequences,” Nwagba stated.

According to him, the move will build a national credit database, offering each citizen a credit profile shaped by their borrowing and repayment behaviour.

He warned that loan defaulters will soon face tangible consequences, including difficulty renewing passports, driver’s licenses, or securing housing.

“There will be no hiding place,” he said.

He added that all financial institutions will now be mandated to report credit activity.

Ngwaba explained that the system is designed to encourage responsible borrowing without being punitive.

“This is not about punishment. It’s about promoting discipline and rewarding financial responsibility,” Nwagba said.

He added that the system will also incorporate financial and non-financial data to generate a comprehensive credit scoring algorithm for every Nigerian adult.

“The goal is simple: every Nigerian must have a credit score. Access to economic opportunities will be tied to how you manage your finances.”

Ngwaba said that the broader objective is aligned with President Bola Tinubu’s Renewed Hope Agenda, targeting improved living standards, reduced corruption, and industrial growth.

“This isn’t just about credit. It’s about giving people access to better lives. When people lack capital to meet their needs, they may resort to unethical practices. We’re changing that,” he said.

He added that the reform would also boost local production by tying credit facilities to the purchase of made-in-Nigeria goods, stimulating demand, creating jobs, and supporting sustainable economic growth.

Nwagba called on the private sector to actively support the initiative, stressing that Nigeria’s credit gap, estimated at ₦183 trillion, cannot be bridged by the government alone.

“No government can fund that level of credit. But with strong institutions and transparency, lenders will have more confidence, interest rates will fall, and Nigerians will have real access to affordable credit,” he said.