The Presidential Fiscal Policy and Tax Reforms Committee has dismissed major aspects of KPMG’s recent assessment of Nigeria’s new tax laws, insisting the firm misunderstood core policy choices and misrepresented preferences as technical gaps.

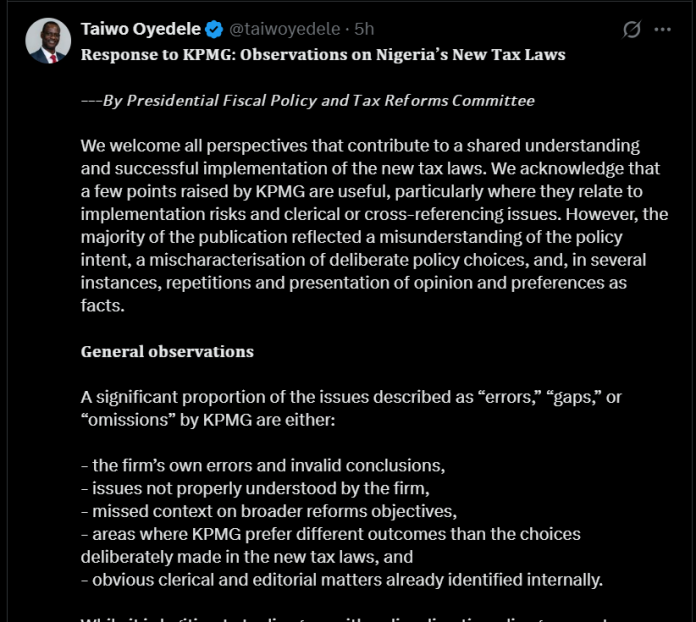

In a statement released Saturday, January 10, via his X handle, committee chairman Taiwo Oyedele said the committee welcomed constructive perspectives but argued that KPMG’s analysis was largely misplaced. “We acknowledge that a few points raised by KPMG are useful, particularly where they relate to implementation risks and clerical or cross-referencing issues,” he said. “However, the majority of the publication reflected a misunderstanding of the policy intent, a mischaracterisation of deliberate policy choices, and, in several instances, repetitions and presentation of opinion and preferences as facts.”

Oyedele stated that many of the issues described by KPMG as “errors,” “gaps,” or “omissions” were either erroneous conclusions by the firm, misunderstandings, or matters relating to preference rather than policy. “While it is legitimate to disagree with policy direction, disagreements should not be framed as errors or gaps,” he noted.

On concerns relating to the taxation of shares and potential sell-offs in the stock market, he argued that such fears were unfounded. “Contrary to the presumption that the new tax provisions on chargeable gains would trigger a sell-off on the stock market, the fact is that the applicable tax rate on share gains is not a flat 30%,” he said, adding that “a significant majority of investors (99%) are entitled to unconditional exemption.”

Responding to KPMG’s suggestion that commencement should align strictly with accounting periods, he said the proposal was too narrow. “The suggestion to set the commencement date as the start of an accounting period takes a narrow view of the complex transition issues,” Oyedele said.

He also defended provisions on indirect transfer of shares as an intentional reform. “The new provision to tax indirect transfer of shares is a policy choice aligned with global best practices,” he declared.

On insurance and VAT, Oyedele opposed KPMG’s interpretation. “KPMG’s point regarding a specific VAT exemption on insurance premium is technically unnecessary,” he stated, arguing that insurance premiums do not constitute taxable supplies under the law.

He further rejected the proposal to exempt foreign insurance companies from tax on premiums written in Nigeria, saying it would “create an unfair and harmful competitive disadvantage for local firms in their own market.”

On foreign exchange deductions, Oyedele maintained that the disallowance of parallel market premiums was deliberate. “This is policy congruence, not an error,” he said.

Defending higher personal income tax bands for top earners, he argued the rate was neither excessive nor uncompetitive. “The rate is not ‘oppressive’ or one that will negatively affect economic growth as claimed,” he said, listing other jurisdictions with higher marginal rates.

He also accused KPMG of factual oversights. “KPMG’s point that the new tax law should be amended to repeal the taxing section of the Police Trust Fund Act is needless, as the provision no longer exists,” he said.

Oyedele added that a balanced assessment would have recognised major structural gains such as tax harmonisation, reduced corporate tax rates, expanded VAT credits and improved incentives. He concluded by urging stakeholders to “pivot from a static critique to a dynamic engagement model,” arguing that implementation, administrative clarity and regulatory guidance would determine real-world outcomes.